Zeros Climate Capital is an investment platform driving high-impact carbon projects across Latin America. Through governance and best practices, we support early-stage initiatives that deliver measurable environmental benefits, financial returns, and long-term integrity.

Our initial fund provides essential liquidity to early-stage projects by pre-purchasing carbon credits and working closely with them to address funding challenges and the lack of impact traceability. We apply our proprietary methodology aligned with the Core Carbon Principles from ICVCM, enhanced with advanced monitoring and robust governance. This approach ensures the quality and integrity of the projects and their credits.

Providing immediate liquidity to early-stage carbon credit projects, offering preferential pricing for an attractive entry point.

Our proprietary, CCP-aligned methodology ensures rigorous project governance and verifiable carbon credits, with medium-term holdings enhancing transparency and sustained impact.

Traceability, transparency, and impactful outcomes over time, adding a premium at sale due to quality and proven track record.

Carbon credits in Nature-Based Solutions (NbS) represent the removal of CO2 through activities such as restoring, conserving, or managing natural ecosystems. Each credit equals one ton of CO2 removed and is verified by independent third parties following international standards to ensure credibility.

These credits incentivize projects and companies to achieve emission reductions. Businesses purchase them to offset their emissions, meet climate goals, and comply with regulations, while also supporting biodiversity, communities, and ecosystem health.

To achieve real impact and ensure a carbon credit of true integrity, governance, additionality, traceability, and permanence are essential. These elements provide the foundation for trust and long-term value in the carbon market.

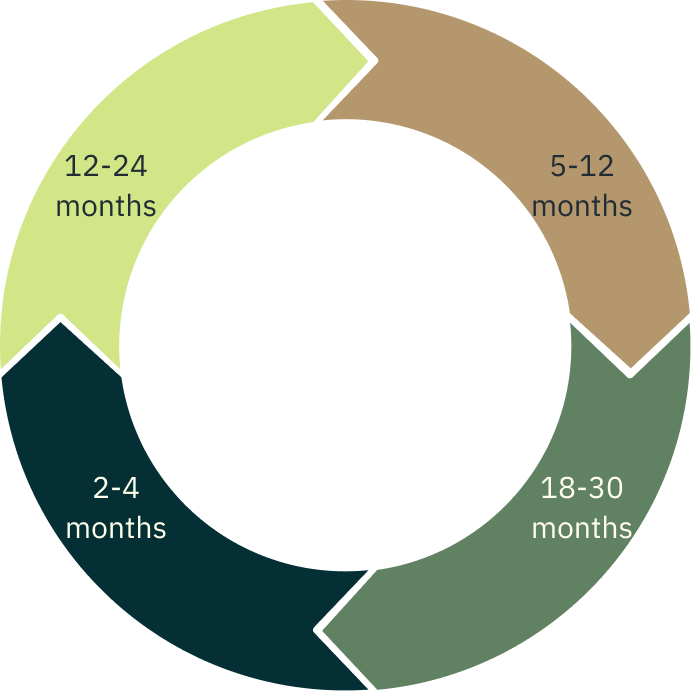

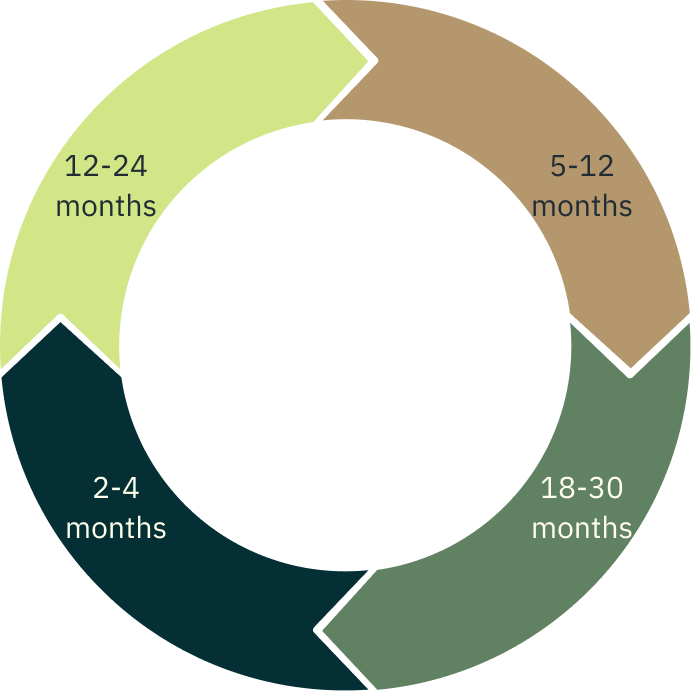

The process of validating the

project with a third party to issue verified carbon offsets, meeting

international standards.

Utilizes CCP-aligned methodology

and real-time MRV to enhance

transparency, capacity building, and project impact.

Zeros Climate Capital invests in Nature-Based Solutions (NbS) projects through a strategic approach that balances impact and returns. We collaborate with landowners from diverse backgrounds, apply moderate leverage to enhance returns while maintaining stability, and enter projects early to drive long-term growth. Our methodology, aligned with the Core Carbon Principles from ICVCM, ensures integrity and measurable impact. By focusing on removals, high-quality carbon credits, and geographic diversification, combined with advanced monitoring using real-time remote sensing, we deliver precision and accountability. With staggered exits every 3-5 years, our iterative investment model captures rising demand and creates sustained value.

The carbon credit market is expected to experience 4-8x

demand growth by 2030, while supply is projected to increase

only 3x during the same period. (Sylvera, 2023)

The carbon credit market is expected to experience 4-8x

demand growth by 2030, while supply is projected to increase

only 3x during the same period. (Sylvera, 2023)

We collaborate with leading developers and landowners whose projects we know firsthand, fostering trust and alignment with our mission. As part of our commitment, we are actively raising capital to scale our impact and support more transformative projects.

Contact us to join this opportunity for strong returns and meaningful impact.